Author Larry Hughes is a professor and founding fellow of the MacEachen Institute for Public Policy and Governance at Dalhouise University.

This year, Canadian households will be paying for their greenhouse gas (GHG) emissions. How much each household pays will depend not only on the amount of energy they consume, but also on where they live.

The different carbon pricing systems used across the country have led to inconsistent pricing that can be unfair to some low- and middle-income households.

The root of this problem is the Pan-Canadian Framework on Clean Growth and Climate Change, which requires all Canadians to pay for their emissions. In order to gain widespread provincial and territorial acceptability, it avoids defining a single, national carbon pricing system.

Instead, the Framework gives provinces and territories flexibility in their choice of carbon pricing systems, as long as it meets a common standard: a carbon tax (like British Columbia’s), a cap-and-trade system (like Quebec’s) or a hybrid system (like Alberta’s). Those that do not implement an approved carbon pricing system must adopt the federal “backstop” program, Output-Based Pricing System (OBPS), and a carbon levy.

Read more: Taxpayers will back a carbon tax if they get a cheque in the mail

The result is a patchwork of provincial or territorial systems, with the carbon price on energy products paid by households varying from province to province.

The carbon pricing systems used in the Maritime provinces are an interesting example for at least three reasons. First, unlike the rest of Canada, the region relies heavily on fuel oil for household heating. Second, New Brunswick and Nova Scotia have had the weakest GDP growth of any province over the past decade. And third, the region has three of the four lowest median household incomes in Canada.

Consequently, the provincial governments in the Maritimes wanted to minimize the impact of carbon pricing on their provinces. Each proposed a provincially designed carbon pricing system to the federal government — as permitted by the Pan-Canadian Framework.

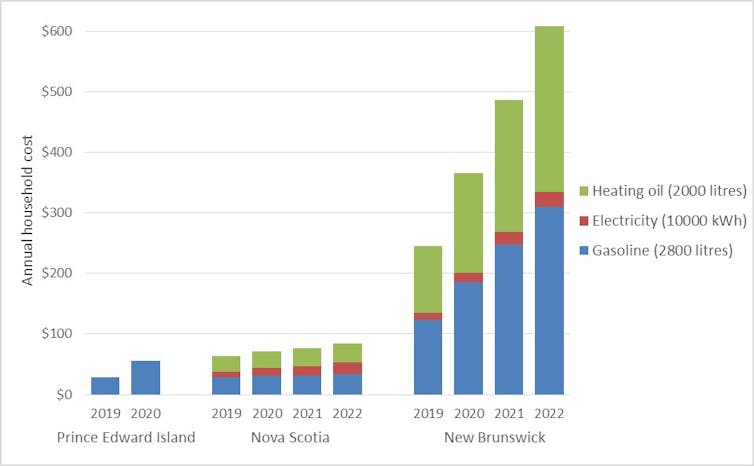

The resulting carbon pricing systems implemented in these three provinces reveals some of the inconsistencies. To understand the impact of the different provincial carbon pricing systems on individuals and families, we simulated the annual cost of carbon emissions for a typical household with the same energy consumption in each of the three Maritime provinces.

Prince Edward Island

The federal government rejected P.E.I’s original carbon pricing plan. Negotiations led to a two-year agreement that will have to be reworked in 2020.

The current agreement applies a carbon price to transportation fuels but not home heating fuel or electricity. The government has further buffered the impact by reducing an existing gasoline tax. Islanders will only pay an additional one cent per litre on gasoline and other transportation fuels in 2019, rising to two cents in 2020.

Nova Scotia

The federal government approved Nova Scotia’s cap-and-trade system. It covers emissions from electrical generation, industries that emit more than 50,000 tonnes of CO2e per year and distributors of liquid fuels and natural gas. The cost of emissions exceeding the cap starts at $20 per tonne in 2019, rising by five per cent per year, and can be passed to consumers.

Gasoline will cost Nova Scotians an extra one cent per litre in 2019 and rising to 1.2 cents in 2022. Home heating fuel will also cost more, starting at 1.3 cents per litre and rising to 1.6 cents. Electricity rates will rise too, increasing 0.10 cents per kilowatt hour (kWh) this year to 0.19 cents per kWh in 2022.

New Brunswick

New Brunswick proposed a climate fund, but the federal government rejected the proposal and applied the federal backstop.

Normally, the backstop consists of a carbon levy on liquid fuels (gasoline and fuel oil), natural gas and the energy used to produce electricity, starting at $20 per tonne of CO2e (carbon-dioxide equivalent) in 2019 and increasing by $10 a year until 2022, when it will be $50 per tonne. But consumers in New Brunswick will not pay the backstop price for electricity. The federal government effectively lowered cost of emissions released from coal-burning plants from $20 per tonne to $1 per tonne, largely viewed as a politically motivated effort to help former Premier Brian Gallant.

The province’s carbon price on gasoline will start at 4.42 cents per litre and reach 11 cents per litre in 2022. Home heating oil is subject to a carbon price of 5.48 cents per litre in 2019, increasing to 13.69 cents per litre in 2022.

Comparing household costs

In our scenario, the household uses 2,800 litres of gasoline to fuel two vehicles, 10,000 kWh of electricity and 2,000 litres of light-fuel oil for home heating.

Household GHG emissions in P.E.I. and New Brunswick are 14.6 tonnes, while in Nova Scotia they are 18.5 tonnes. The difference lies in the way electricity is generated: fossil fuels generate about 40 per cent of the electricity in P.E.I. and New Brunswick, and 75 per cent of the electricity in Nova Scotia.

In P.E.I., the household cost of carbon emissions, which only includes gasoline, begins at $28 in 2019 and rises to $56 in 2020. The province says it will return “every cent collected to Islanders.”

The costs for a household in Nova Scotia start at $64 in 2019 and rise to $85 in 2022, but the household does not receive rebates.

New Brunswick residents pay the backstop carbon price for gasoline and heating oil, but not for electricity. The annual cost is $245 in 2019 and almost $610 in 2022. They can claim a “Climate Action Incentive” rebate on their taxes and receive $256 in 2019 (rural residents receive an additional 10 per cent).

The problem with rebates

While rebates may appear to be an equitable solution, they are paid once a year, forcing low- and middle-income households to carry the additional costs of the carbon price on energy products throughout the year.

In addition, the refund is based on family size, not consumption. This means that someone heating with wood (and paying no carbon tax) receives the same refund as someone with the same income but heats with oil. On the other hand, households with carbon-tax expenditures exceeding the refund must absorb the difference.

Read more: Rethinking Canada's climate policy from the ground up

Reducing greenhouse gas emissions is central to the Pan-Canadian Framework. However, if carbon pricing is to make a meaningful contribution to emissions reduction in Canada, it must be:

Consistent: The cost of emissions and the associated carbon pricing system should be independent of where someone lives.

Fair: Rebates to low- and middle-income households should be designed to minimize the impact of rising carbon prices, by making rebates available throughout the year as is done in Alberta, for example.

Without addressing issues such as these, opposition to carbon pricing can only be expected to grow.![]()

This article was first published on The Conversation, which features includes relevant and informed articles written by researchers and academics in their areas of expertise and edited by experienced journalists.

Dalhousie University is a founding partner of The Conversation Canada, an online media outlet providing independent, high-quality explanatory journalism. Originally established in Australia in 2011, it has had more than 85 commissioning editors and 30,000-plus academics register as contributors. A full list of articles written by Dalhousie academics can be found on the Conversation Canada website.